Since the start of the pandemic, the buy now, pay later (BNPL) market has experienced exponential growth according to the research data analyzed and published by Definanzas.com. The top BNPL apps in the market have seen the number of monthly active users surge by 186% year-over-year with app installs growing by 46% YoY.

BNPL services are especially popular with younger generations with data showing 57% of the Gen Z population and 40% of millennials using a deferred payment strategy for purchasing. When BNPL started out, it was primarily a solution for big-ticket purchases, but has gradually gained traction for smaller purchases as well, with consumer electronics accounting for the majority of purchases, at 44%. The clothing or fashion segment is second, while household appliances and furniture, the consumer items that were the reason a pay later strategy was invented, now rank third.

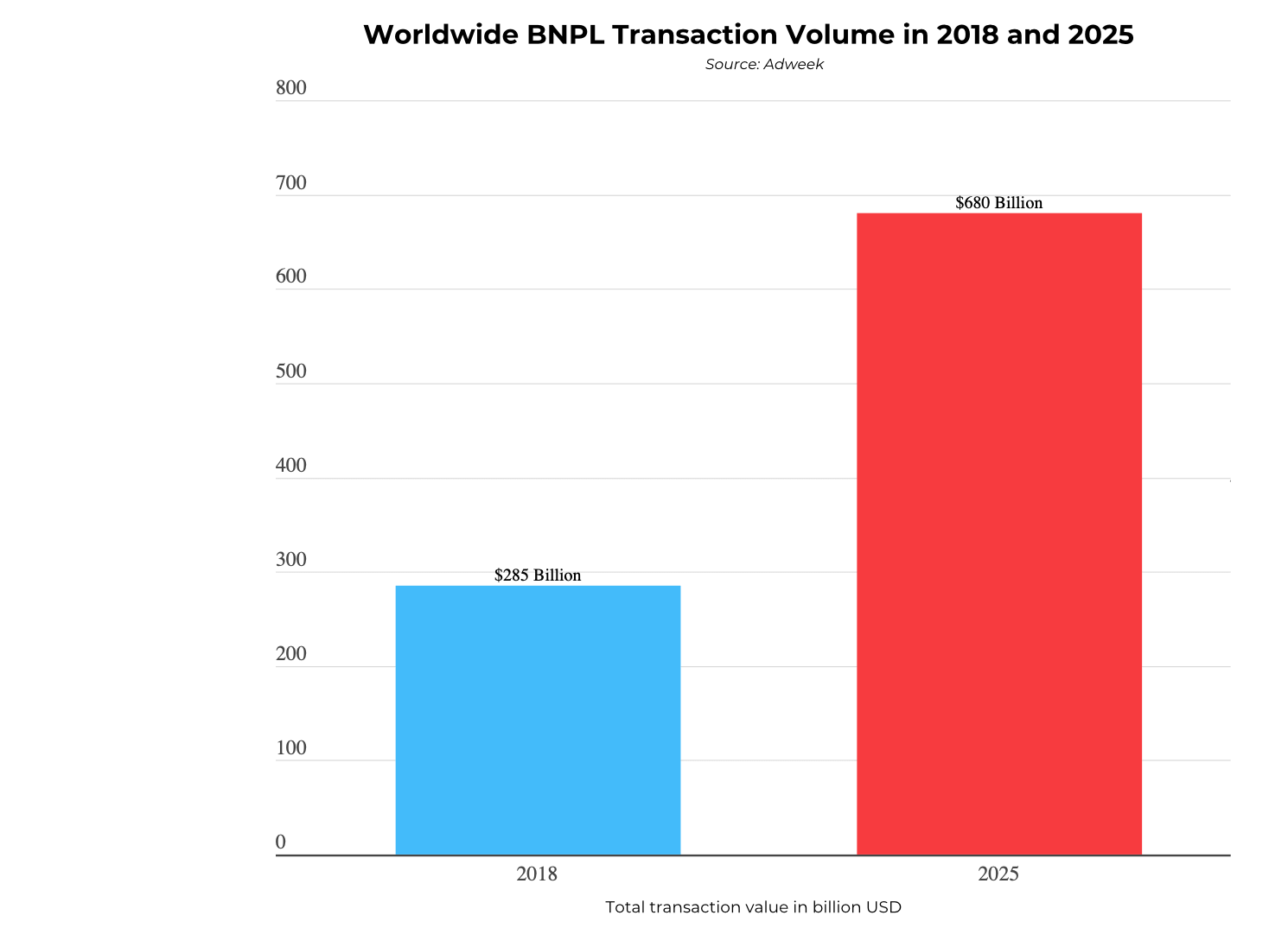

For millennials and Gen Z users, the majority of deferred spending goes toward fashion items. BNPL is expected to keep growing despite bottlenecks resulting from potential regulations and consumer concerns. Based on a study by Adweek, global BNPL transaction volume will surge to over $680 billion by 2025. In 2018, the market was only worth $285 billion, about a third of the predicted 2025 figure.

Among the reasons cited for the popularity of BNPL services is a desire by consumers to avoid the use of credit cards altogether. According to a Bank of America (BofA) survey, consumers consider BNPL to be a budgeting tool by allowing online purchases to be split into multiple payments that can be made over a period of time. Moreover, they assist users to avoid the high interest rates associated with credit card payments.

BofA estimates that the market for BNPL apps will grow ten to fifteen-fold by 2025. That would place its global transaction value in the range of $650 billion to $1 trillion.

Unlike traditional credit cards, most BNPL services do not make money from interest rates or fees charged to the consumer. Rather, they charge merchants, a fee to receive payment in full who then take on the debt with the individual consumer.

How long Buy Now Pay Later takes to disrupt the $8 trillion credit card industry remains to be seen. According to Worldpay Retail Global Payments, the percentage of transactions using BNPL options in North America is estimated to increase from 0.9% in 2020 to 3% in 2023.

A Capgemini survey cited by eMarketer states that credit cards are still the most popular payment method globally. 62.4% of the survey’s respondents preferred credit cards, compared to 30.1% for BNPL. A wide variety of payment options available to consumers is also expected to contribute to the slow adoption of BNPL. 52.7% of the survey’s respondents preferred debit cards, 48.9% internet banking and 46.1% mobile payments.

Eager to maximize the BNPL market’s potential growth, companies such as Klarna, Afterpay and Affirm are emerging as global frontrunners joining payment service incumbents like PayPal. PayPal’s BNPL option has attracted 330,000 merchants and 3.3 million unique customers since its launch in August 2020.

New shopping habits such as BNPL are expected to push global eCommerce figures to new highs in 2021. Adobe’s Digital Economy Index states that digital commerce could surge by an astounding 20% this year to reach $4.2 trillion.

The report revealed remarkable growth in US online purchasing in March 2021. It attributed the increase partly to ongoing vaccinations and partly to stimulus checks. Based on estimates, consumers in the US spent about $8 billion on eCommerce in a span of three weeks. The period covered the weeks of March 11 to March 31 2021.

Based on recent data, consumers are also taking advantage of new payment models like BNPL. In the month of March 2021 alone, BNPL purchases jumped by 166% YoY. Lower than the 215% uptick in January and February 2021.

Additionally, worldwide eCommerce value rose by 38% during the first three months of 2021. That drove the total to $876 billion. For the US market, a report by Adobe projects that digital commerce value will rise to $1 trillion by 2022. During Q1 2021, the market grew by 39% reaching $199 billion. March 2021 was a particularly good month with consumers spending $78 billion, up by 49% YoY.

The US will be a significant part of the global recovery in eCommerce sales during the year. It is expected to contribute at least a fifth of the global figure, between $850 billion and $930 billion.