If you’re looking for a movie or TV show to watch, chances are one of the first sources you rely on to tell you where it’s available is JustWatch.com. Type in any title, select any country, and you’ll instantly find where the content is streaming, and/or where you can download, rent, or buy it. Needless to say, JustWatch knows a lot about the world of streaming video. And its latest survey indicates that interest in streaming platforms are experiencing a shift in terms of which services are on top.

The JustWatch U.S. Streaming Catalog Popularity – Q2 2025 survey compares U.S. Streaming Video on Demand (SVOD) movie and TV show catalog popularity across major platforms between April 1 and June 30, 2025, using more than 35 million engagement signals from 20 million users. Meanwhile, the Q2 2025 Market Shares – Canada report provides some insight into the Canadian streaming landscape as well.

It’s important to note that users searching titles doesn’t necessarily translate to actual viewer numbers. But the data does represent a snapshot of what people are interested in. JustWatch calculated its data looking at activity like click-throughs on streaming offers, watchlist additions, title page views, trailer plays, and “watched” marks. It then weighed the interactions by level of streaming intent: lower for passive signals like watching a trailer and higher for active ones, like click-throughs and completed viewings.

The short time the data is collected also needs to be taken into consideration, especially if a high-profile show or movie was released during those months on any of the streamers, which would instantly contribute to its rise up the ranks. That said, pretty well every streamer had at least a few hot movie and/or TV show titles released through that three-month period.

What U.S. Streamers Are Tops for Movies?

Interestingly, Amazon Prime Video led the quarter in the U.S. for both total movie catalog popularity and average movie catalog popularity. This, says JustWatch, is thanks to a mix of exclusive releases and strong legacy film performance. Hot titles released during that period include the Accountant 2, which reached number one in the U.S. streaming charts. Deep Cover also performed well and there were upticks in popularity for Nosferatu and Conclave.

In second place was Hulu in both total movie catalog popularity and average movie catalog popularity. Popular titles included 28 Weeks Later and Independence Day, along with newer titles like Anora, Presence, and Predator: Killer of Killers.

Netflix ranked third, mostly thanks to its exclusive content like The Old Guard 2, Heart Eyes, and Havoc.

HBO Max outranked Netflix in average movie popularity, benefitting from early access to high-profile theatrical releases. Some top titles included Mickey 17, A Minecraft Movie, and Sinners.

Disney+ saw renewed success with Disney/Fox-owned genre films directed by Danny Boyle while also gaining traction through new Marvel entries as well as older titles, including Captain America: Brave New World, 28 Weeks Later (driven by renewed interest following the theatrical release of 28 Years Later), and Sunshine.

Apple TV+ doesn’t have nearly as much content as the others, but the quality-over-quantity strategy is working as the streamer maintained high average popularity with several breakout titles. Top titles include Fountain of Youth, Echo Valley, and The Gorge.

What U.S. Streamers Are Tops for TV Shows?

What about when it comes to TV shows? The survey found that Amazon Prime Video, once again, led the quarter in total series catalog popularity, driven by a handful of exclusive standouts. Popular titles included the sixth and final season of The Handmaid’s Tale, followed by Your Friends & Neighbors, an Apple TV+ original series that was available to stream. The Bondsman also performed well, though the series has since been cancelled. However, the streamer ranked fifth in average popularity due to the concentrated nature of its successes.

Netflix followed closely in total series popularity, supported by exclusive content like Squid Game’s final season, Dept Q, The Four Seasons, and The Eternaut.

Hulu followed Netflix in total popularity, anchored by a diverse mix of animation, reality, and critically acclaimed drama. These include season eight of Rick and Morty, Love Island USA, and The Bear season four.

Apple TV+ topped all platforms in average series popularity, including Stick, Murderbot, and The Studio.

Disney+ ranked second in average series popularity, boosted by both franchise strength and new originals. Popular titles included Andor season two, Ironheart, and The Bear season four, which was also available to stream on Disney+.

HBO Max placed third in average series popularity and fourth in total, led by several high-impact dramas. The White Lotus (season three) and The Last of Us (season two) were big draws along with The Gilded Age season three.

Overall U.S. Market Share Examined

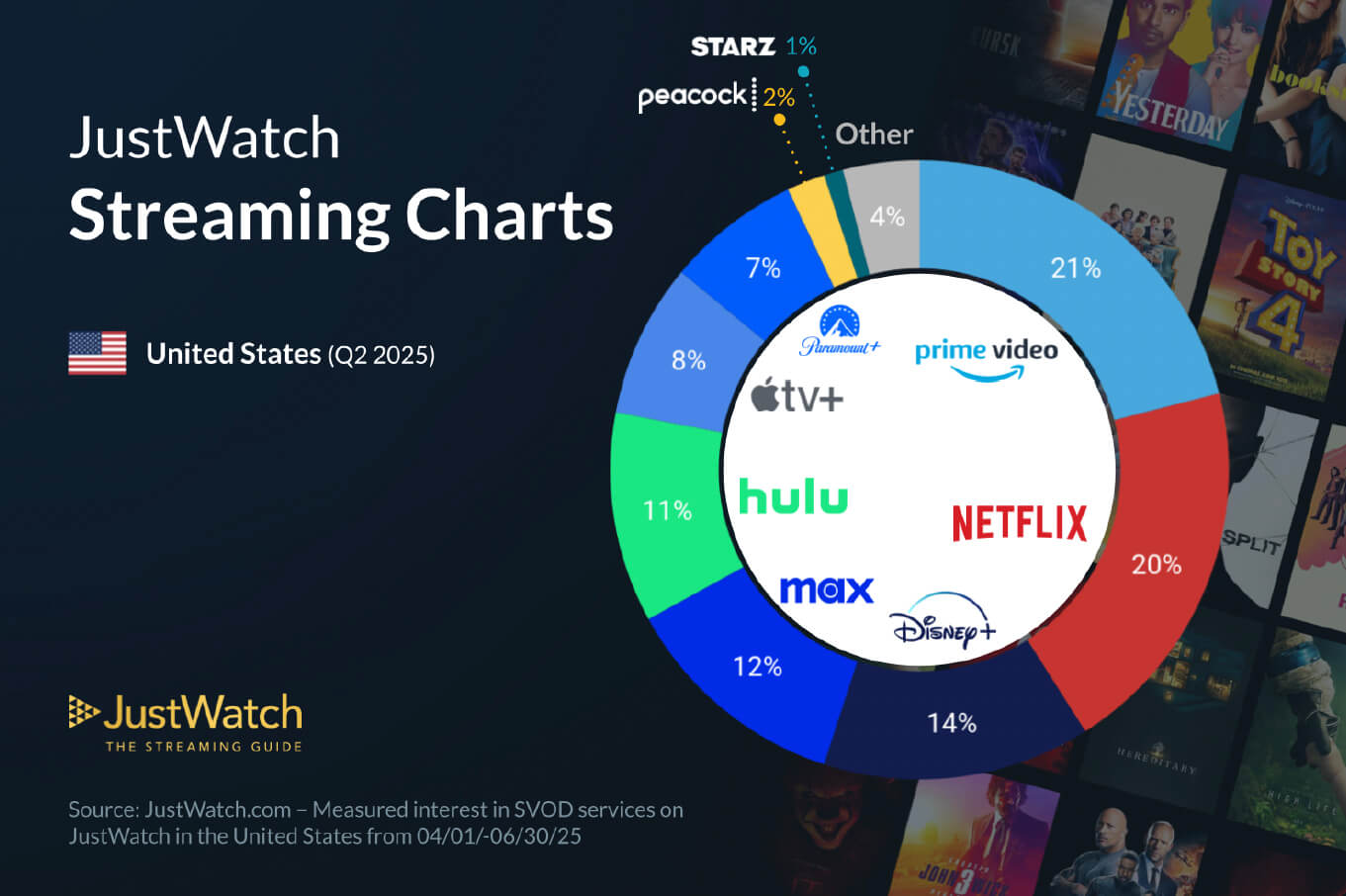

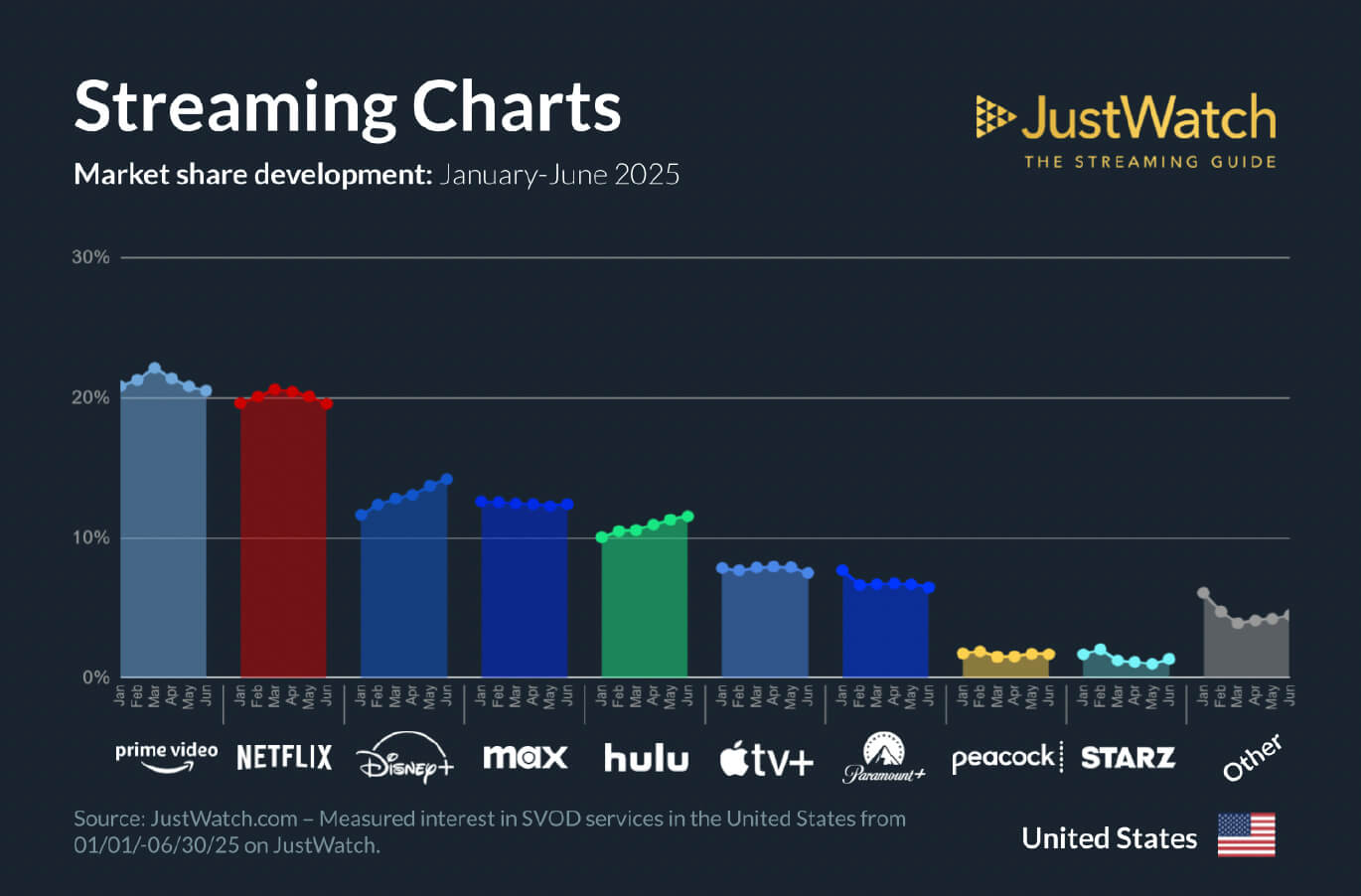

In terms of overall market share in the U.S., according to JustWatch and its methodology as noted above, Amazon Prime Video led at 21% followed by Netflix at 20%, Disney+ at 14%, HBO Max at 12%, Hulu at 11%, Apple TV+ at 8%, Paramount+ at 7%, Peacock at 2%, and Starz at 1%. Other streamers accounted for 4% combined.

Disney+ showed the most growth, up two points from Q1 while HBO Max dropped slightly. Hulu was up slightly, but enough to overtake Max while Apple TV+, Paramount+, and Peacock remained stable. Starz, however, lost half its share, falling from 2% to just 1%. Other services fell slightly from 5% to 4%.

Looking year-over-year, Disney+ had the strongest growth of 2%, followed by Hulu with 1% growth. Amazon Prime Video and Netflix both dipped 1%, though together, they still dominate the market. HBO Max and Paramount+ saw the largest declines, each falling 2% compared to the same time last year. Apple TV+ lost 1% and Peacock and Starz were steady. Other platforms grew by 1%, which JustWatch attributes to fragmentation at the bottom of the market.

Bottom line: there’s a lot of movement in the middle, but Amazon Prime Video and Netflix hold strong positions, and Disney+ is a rising contender. HBO Max and Hulu will need some big titles to help drive up their numbers, while Starz may find better performance through bundling, though they might already be accomplishing that and JustWatch’s data doesn’t take it into account.

What About Canada?

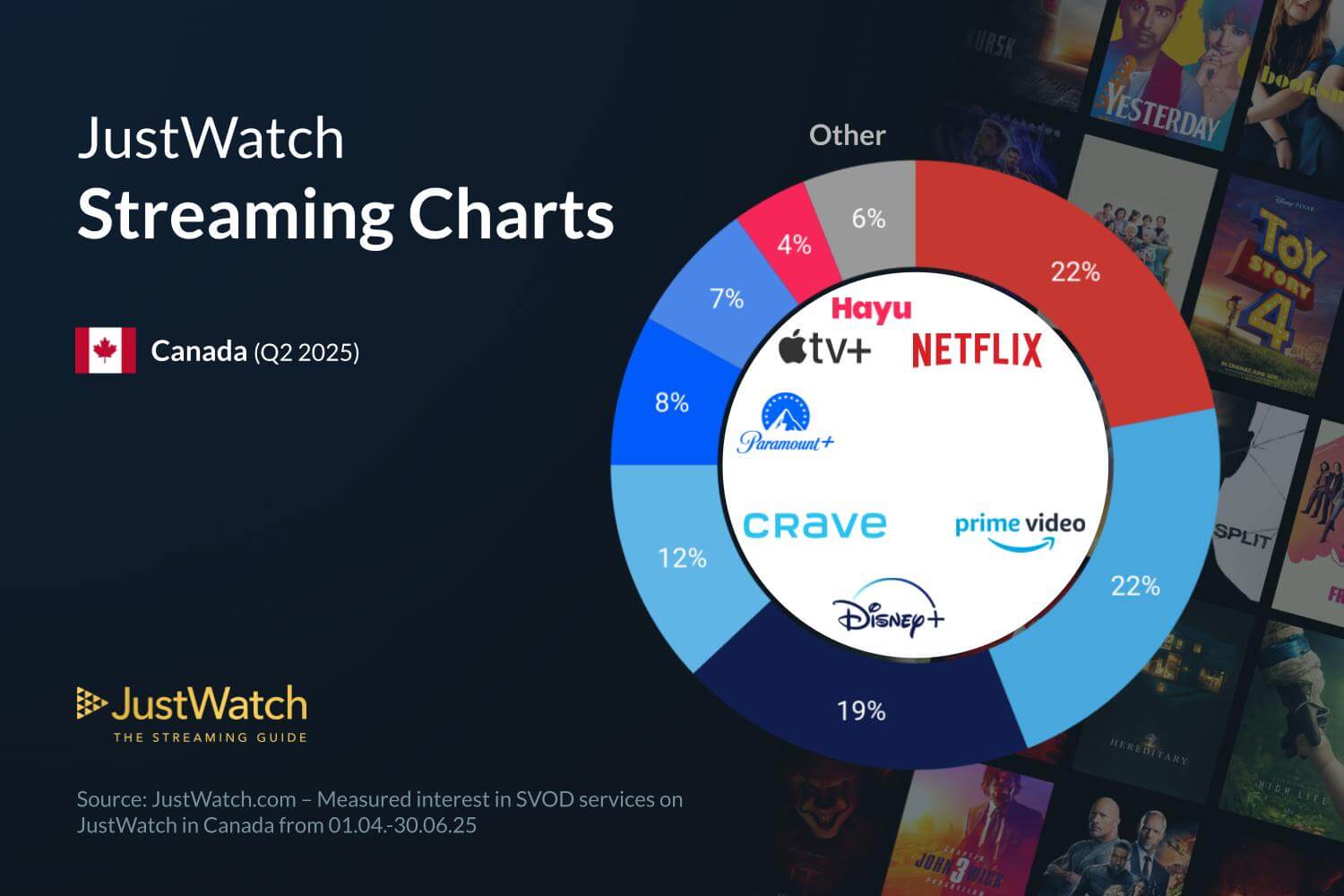

While JustWatch’s data isn’t as comprehensive for Canada, the company has analyzed market share north of the border as well.

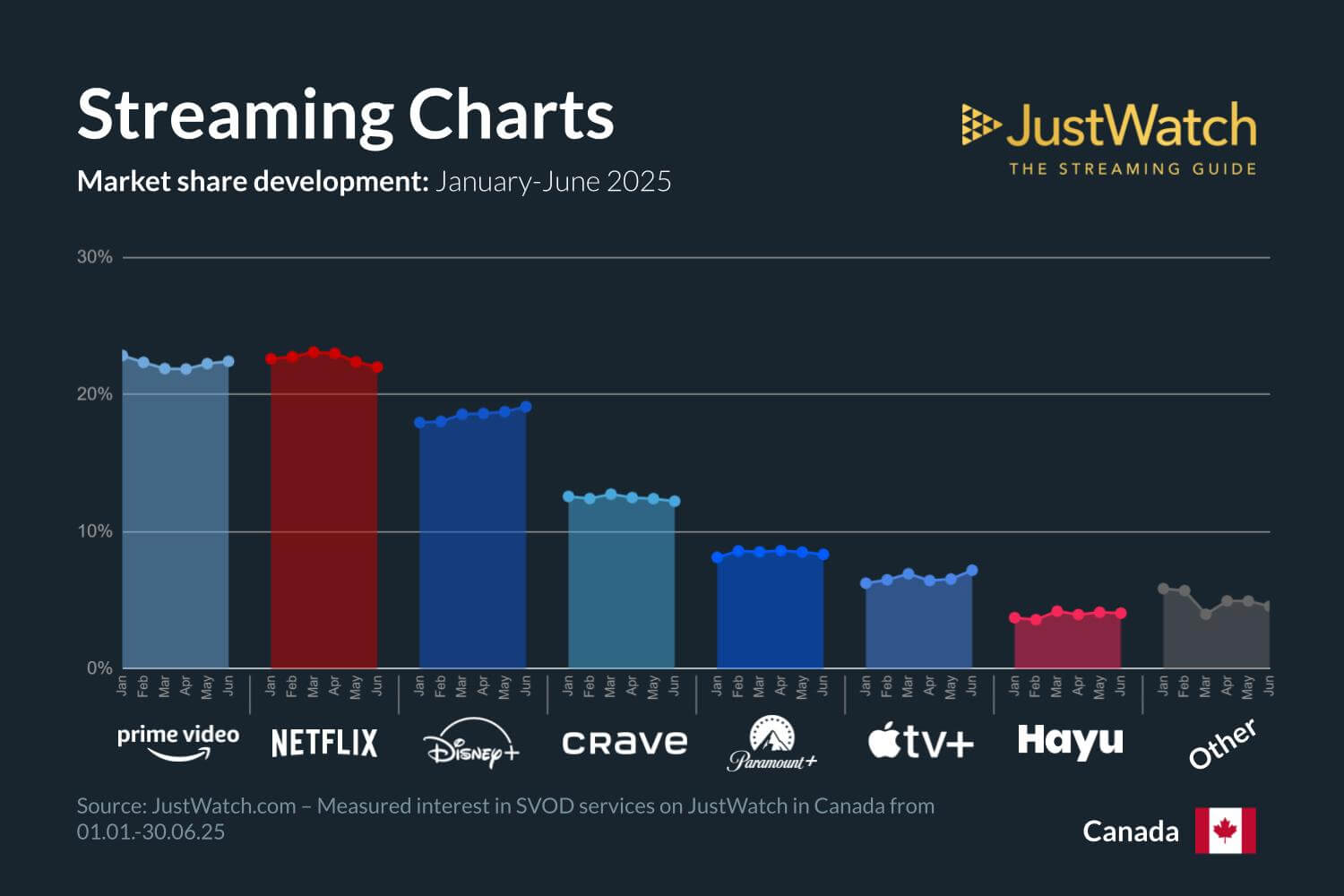

In Canada, Netflix and Amazon Prime Video are tied for first through Q2 2025 with both claiming a 22% share. Disney+ follows behind at $19% while Crave (which offers HBO Max content as well) is at 12% and Paramount+ (including Showtime content) is 8%. Rounding out the rest is Apple TV+ (7%), Hayu, which offers reality TV shows, at 4%, and “other” at 6%.

In terms of 2025 to date overall, Amazon Prime Video and Disney+ both saw small gains of 1% while Crave and Netflix both slipped by a percentage point.