By Robert Gumiela

We all like to point fingers, to blame someone else for our angst and woes. We are famous for complaining, complaining about the government, taxes, the weather, time changes (by the way, after one week of daylight savings time I don’t hear anyone complaining about the extra hours of sunlight in the evening, and especially in July when many take vacations, so suck it up buttercup!), traffic, the weather, high prices for food, the weather, high interest rates and on and on and on, oh my.

Retail is a very nasty business, regardless of the industry. It has been well established that 95% of new non-franchised (read McDonald’s, Tim Horton’s, Wendy’s) restaurants close within the first five years of operation. The COVID-19 pandemic most certainly played a major role in accelerating the demise of many retail food outlets, however more recently we have witnessed a continuation of American-based retailers announcing the closure of their Canadian operations. If you look pre and post COVID a very partial list of big box retail leaving Canada includes these now defunct American retailers: Sears, Target, Bed Bath & Beyond, Sam’s Club, Kmart, Nordstrom/Nordstrom Rack, Payless Shoes

One can point to any number of economic reasons why these titans of retail have (or are being) closed, but one singular issue that most overlook is that “CANADA HAS TOO MANY RETAILERS”. As a reference to the simplicity of my postulation I would like to quote James Carville, political strategist and advisor to Bill Clinton, “It’s the economy, stupid”.

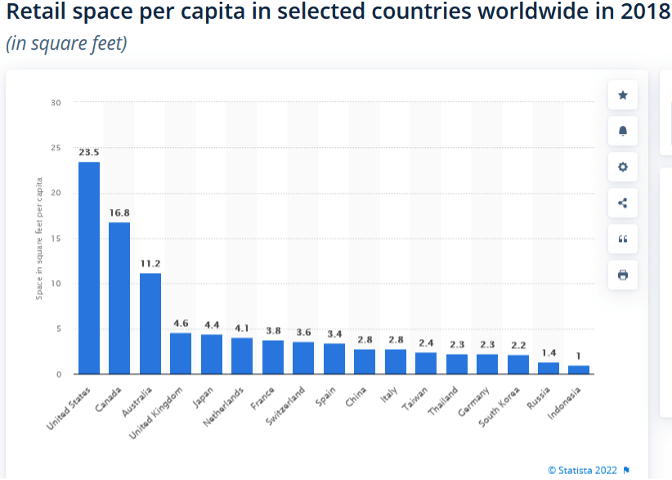

If you examine the global retail statistic of per capita retail square footage sales (see chart), Canada has nearly 4 times the per capita retail square footage of the United Kingdom and Japan; only the USA has a greater number (likely due to the enormous number of fast-food outlets and accompanying burgeoning waistlines!).

Canadian urban planners regularly point to the spike in urban sprawl that started in the late 1950s. The automobile made it possible for consumers to go further and faster, subdivisions with their detached bungalows and white picket fences popped up everywhere land became available and it only made sense that where people lived, services were required from groceries to dry-cleaning, gasoline to hardware stores, banks to pizza parlours.

If we wind ourselves back in time to the pre-war era, urban centres were for the most part a collection of community clusters. Growing up in the Junction, which is the west end of Toronto, north of High Park, the main commercial artery was Dundas Street West, and it was home to three supermarkets, jewellers, banks, restaurants, shoe stores, clothing stores and so on. All of these retail outlets were within an easy walking distance of the local community. This scenario repeated itself throughout the city; there was Little Italy on College Street, Bloor West Village, Roncesvalles, et al, culminating in a downtown cluster of major retailers such as Eaton’s and Simpson’s. Yonge Street was a gold mine of retail that was famous for its selection of record stores, clothing stores and electronics retailers. Many of the long-lost CE retailers on the Yonge Street strip include Toronto Hi-Fi, Kelly’s, Hi-Fi Express and many others. In each instance, these retail communities were specific destinations for either the local community or in the case of the downtown core, the entire city.

As urban expansion continued many streets became known for their retail concentration such as the Kennedy Road strip in Scarborough, and Dundas Street West in Mississauga. It didn’t take long for two new retail behemoths to emerge: the Power Center and the Regional Shopping Mall. The Heartland Centre in Mississauga is an enormous retail enclave where one can literally find any type of good or service. Suburban malls such as Square One, Scarborough Town Centre, Yorkdale, Fairview, Sherway Gardens all put a stake in the ground, attracted a mobile clientele and expanded their footprints. But now even the Power Centers and the Regional Malls are struggling as lease rates have skyrocketed exposing for all the challenges of meeting the key criteria for retail success, sales per square foot. Walk through any major mall any inevitably you will see an unusual number of vacancies, similarly as you drive through and around Power Centers. Following is a brief list of retailers (and the number of locations where available) that have either abandoned the Canadian market, become outlet shops or have shrunk their national locations, many of whom were once the anchor tenant to populate shopping malls:

Mexx Canada (95); Solutions; Smart Set (107); Jacob (92); Addition Elle (77); Agnew Surpass (223); Bentley Leathers (90); Bombay Company; Bowring; Bryan’s Clothing (27); Gymboree (49); Home Outfitters; Jean Machine (24); Nando’s (21); Pier 1 Imports (67); Stokes (40); Thyme Maternity (54); Town Shoes (38); Victoria’s Secret (13); Toys “R” Us (80); Forever 21 (200); J. Crew (54); Party City (now absorbed into Canadian Tire locations) And Electronics Retailers who have disappeared include: Atlantique, Aventure, Dumoulin, Future Shop, Sony Stores, Bose, HMV, A&B Sound, Wacky Wheatly’s, Multi-Tech Direct, Hi-Fi Express, Majestic Sound Warehouse, Fairview Electronics

Across the country a new phenomenon is taking place; the concept of “de-malling” The Brentwood Town Centre in Burnaby B.C. has transformed into a mixed use retail/service/residential community space. In the GTA many small malls have also been designated for rehabilitation, converting abandoned anchor stores and parking lots into high-rise residential buildings. Bramalea City Centre, the Galleria Shopping Centre, Agincourt Mall, the Malvern Town Centre are just a few examples of malls that are either being razed or re-developed to include high density residences. In simple terms all these new developments have been borne from the fact that Canada simply has too much retail square footage. By increasing residential density within walking distance of the retail outlet the net result should be a significant increase in sales per square foot. In retail, as fixed costs outweigh variable expenses it is critical that sales per square foot increases.

The absolute darling of retail is the Apple Store, which averages $6,050 per square foot per location. The two absolute superstars of retail are Ikea which has 14 stores in Canada, $2.6 billion in annual sales and an average of $186,000,000 per store and Costco which has 107 locations in Canada, averaging $526,000 per day per location or $200,000,000 per store. No one comes close, not even Canada’s largest retailer, Loblaw who dominates the market in terms of total sales.

According to Statistics Canada data, in 2021 the total retail trade in Canada was approximately $674 billion dollars, an increase over 2020 which recorded total retail sales of $606 billion dollars. In the on-going battle of survival for bricks and mortar stores there is the elephant in the room known as Amazon, which in 2021 recorded $US 9.817 billion dollars or approximately $13 billion dollars Canadian in retail sales. While this total only represents 2% of the total Canadian retail industry one has to remember that Amazon does not participate in the top four Canadian retail categories; Automobiles (27%), Building Materials (7%), Food (19%), and Gasoline (10%) for a total of 63% of all retail sales. Oddly enough these top four retail categories are predominantly in-person experiences (especially gasoline!).

One final interesting set of numbers is that the three largest industries measured by their contribution to the $US 1.64 trillion dollar GDP are in order; real estate, manufacturing and mining. As real estate prices have soared over the past 10 years, they have outpaced consumer earnings as a ratio of price to earnings. Where housing costs as a percentage of income have exceeded the danger zone, it has led to less disposable income for discretionary purchases. Again, not enough money to go around to spend at retail.

The next 10 years will be both challenging and interesting for the retail trade. The retailers who will be thriving at the end of the next decade will be those who have recognized the need to continually evolve and improve, especially in the area of sales per square foot. Without doubt there will continue to be retail failures. Those who fall prey likely haven’t yet realized that they are in the danger zone.

Robert Gumiela spent his career running the marketing teams in Canada for both Toshiba and Samsung before spending the next ten years as Vice President of Marketing for the Power Group Retail Solutions. Robert is now a freelance essayist reporting on business development and social issues.