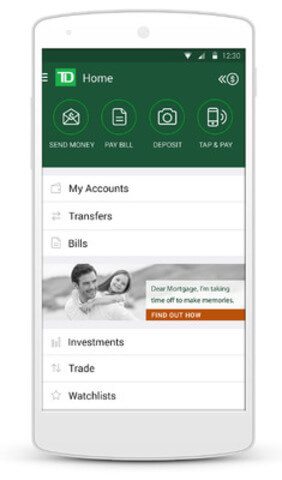

TD has announced an enhanced version of its mobile app to include guided solutions for customers that use the bank’s data analytics and artificial intelligence (AI) capabilities.

Mew digital insights within the TD app are designed to prompt customers with guided self-serve options based on their transaction history. These insights offer pro-active guidance to help customers to complete an action without having to search within the app or navigate to the external site.

Customers who complete a third-party international remittance transfer will be prompted with the option of securely sending money through TD Global Transfer directly from their TD account within the TD app. TD Global Transfer is a marketplace that provides TD customers with convenience for sending money almost anywhere in the world.

Customers will now receive targeted information through the TD app informing them that a new TD Access Card is on the way when the card has expired, explaining the options for how to activate their card along with useful information about the card features, including how their TD Access Card can be used to make online or in-app purchases and pay re-occurring bills.

Digital insights have also been introduced to the mobile experience to support TD Direct Investing clients when they open a new account with future insights based on the frequency of their investment activity.

Offering proactive engagement to TD Direct Investing clients, digital insights will drive clients to “how-to” information and educational resources. Clients will be prompted as soon as a TD Direct Investing account has been opened with information such as how to look up a quote or how to set up an investment watchlist on the TD Direct Investing trading platform and support them through the steps for making their first investment. Once the account has been funded, insights will inform clients of tools and educational resources that are available to them to help build their investing confidence and make them a more informed investor. The launch of this experience caters to the do-it-yourself (DIY) investor mindset.

These experiences build on TD’s introduction of AI-powered insights to support customer cashflow management for personal banking customers with predictive insights into their upcoming transactions.

Low Balance Prediction insight alerts customers who are likely to encounter a low balance in the next two weeks so that they can give priority to their important spending needs, while

Upcoming Transactions insight provides a list of upcoming bills within the next two weeks based on recurring transactions to help customers who have challenges with cash flow.

In each instance, customers are provided with personalized contextual options like being able to transfer funds and viewing their schedule of upcoming payments to better plan for their financial obligations.

In 2022, TD expects to have over 30 live use digital insights designed to offer proactive guided customer experiences within the mobile app.

“We are seeing through high levels of engagement in these experiences that digital insights are an effective way to support our customers with information that is relevant in a digital setting,” says Rizwan Khalfan, Chief Digital and Payments Officer, TD BankGroup. “As we continue to evolve to meet the changing needs of our customers, we are committed to finding new ways to help support their digital confidence.”