A new study from Juniper Research has found that the total number of digital wallet users will exceed 5.2 billion globally in 2026, up from 3.4 billion in 2022; representing strong growth of over 53%. The research predicts that the presence of ‘superapps’ will drive digital wallet use in developing countries that are currently considered cash heavy.

Superapps are multipurpose apps able to integrate digital payments alongside other services, including wealth management and eCommerce. The study identified three countries in Asia Pacific primed for rapid growth over the next four years: Philippines, Thailand and Vietnam.

Driven by brands such as Apple Pay and Google Pay, and supported by smartphone and mobile device penetration, digital wallets are becoming go-to payment methods, especially within certain geographies and demographics, such as younger generations across Asia and Southeast Asia.

It predicts that the adoption of digital wallets will near 75% of the population in each of these countries by 2026. It cited the rising access to online and mobile commerce services as driving forces behind the use of digital wallets, notably through superapps.

Additionally, the research identified QR code payments as the most popular digital wallet transaction type in 2026; reaching 380 billion transactions globally, and accounting for over 40% of all transactions by volume. However, as usage within markets including China and India reaches its apex, vendors must innovate to remain competitive entering new geographic markets. Therefore, the research recommends that QR code payment vendors integrate loyalty features and personalised marketing capabilities to incentivise merchant acceptance, which will be critical to driving adoption.

Digital wallets have enjoyed growing popularity as a payment method in recent years. With restrictions imposed by the COVID-19 pandemic, as well as a broader goal of financial inclusion by eliminating cash from daily financial transactions adopted by many governments worldwide, digital wallets have found themselves to be at the forefront of a new payments ecosystem.

Adding to the cashless and contactless payment trends already underway, digital wallets offer several other benefits, mostly of convenience, speed, and security, as users do not need to remember PINs and passwords when making in-store purchases or fill in security credentials when buying online. Furthermore, emulating their physical counterparts, digital wallets are equipped with capabilities to store identity documents, such as a driver’s license or loyalty card information, and to serve as a primary interface for cryptocurrencies. As such, these wallets create new business opportunities for vendors by cross-cutting into different technology areas like digital identity. Digital wallets can also be catalysts for financial inclusion by presenting a simple first step for unbanked/underbanked population segments to participate in the global economy, since they do not necessitate physical bank accounts for payments.

Google was the first company that launched its mobile wallet solution in 2011, while Apple launched its Passbook in 2012, which did not involve payment capabilities, but was rather only as a document storage for boarding passes, tickets, and coupons. Its solution with payment capabilities, Apple Pay, was subsequently launched in the US in October 2014. It was then launched in the UK and China. Apple Pay utilises NFC (Near-field Communication) technology and customers could not only pay, but also earn loyalty points and redeem coupons. It later introduced P2P services through Apple Cash as a functionality within Apple Pay. In 2015, Android launched Samsung Pay, developed following the acquisition of LoopPay by the company Launched in the UK in May 2017, Samsung Pay is an app that enables users to turn their Samsung Galaxy smartphones or watches to digital wallets. It also supports digital card solutions for non-compatible banks and building societies through Samsung Pay+ app, which allows users to merge every card from any bank into one digital card.

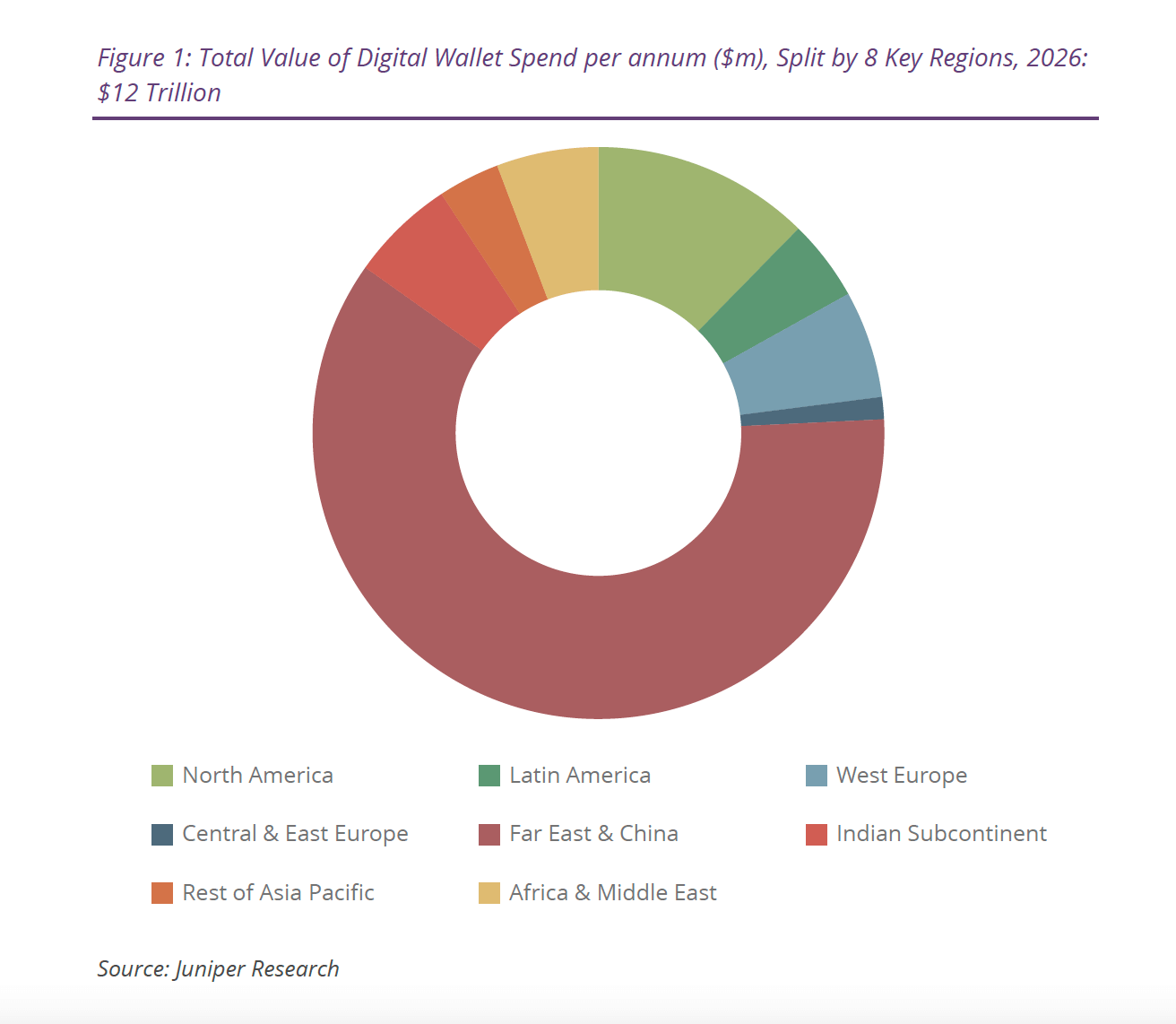

The value of digital wallets transactions will exceed $12 trillion in 2026, from $7.5 trillion in 2022. To capitalise on this substantial growth, leading digital payment vendors will diversify their payment products to include new solutions, such as buy now pay later and cryptocurrencies.

The read the full report click here.