Wise, which has gained popularity for making it simple to send and receive international payments without hefty bank fees, has introduced a new feature for Canadians: Interac e-Transfer Autodeposit.

Canadians with a Canadian dollar Wise account can activate this balance to receive money via Interac. Simply open a Canadian balance, click on the Canadian Balance on the website, select Receive and Receive with Interac. Select Register e-mail with Interac. Once you receive an e-mail to complete the registration, follow the instructions then look out for a confirmation e-mail. This will note that your Interac account is now registered with Peoples Trust Company, Wise’s banking partner.

When your payers send money to your registered Interac e-mail address, you’ll receive it into your Wise Account. Interac payments can be received 24/7 within 10 to 20 minutes including on weekends and bank holidays. (This may depend on specific circumstances and might not be available for all transactions).

“We’re excited to continue making our products feel even more local for Canadians and this new option of auto deposit from Interac just does that,” says Ankita D’Mello, Senior Product Manager at Wise. “At Wise, we are always listening to customer feedback and our Canadian users have been asking for a simple, fast and convenient way to receive payments from friends and family. With Interac e-Transfer Autodeposit now live, our Canadian customers can better utilize their Wise Account for more of their financial needs.”

Interac e-Transfer Autodeposit is the latest in many new features Wise has offered over the last year. In August 2022, the company introduced the Interac e-Transfer Request Money Feature, which makes it simple for Canadians to move money into their Wise accounts using their e-mail address or mobile number. Money is typically available within 30 minutes. Just prior to that in March, Auto Conversions was introduced, allowing you to set a desired exchange rate for Wise to convert the money to when that desired rate is met in the market.

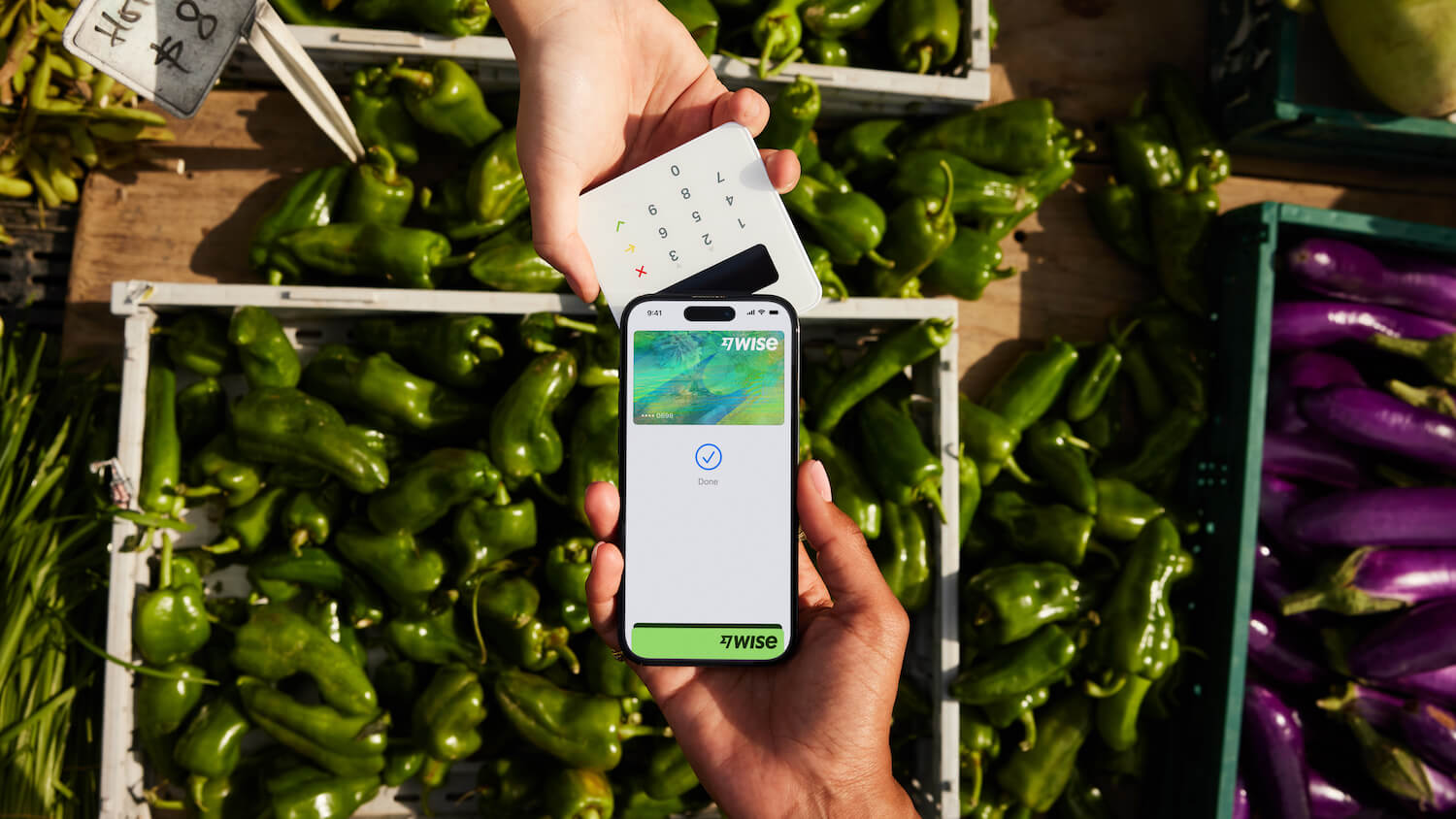

In November 2021, Wise also brought its Wise Card to Canada, which purports to offer three-times cheaper rates than banks when spending abroad. You don’t have to worry about foreign transaction fees or unsavoury exchange rates from the big banks.

Finally, Canadian customers have long been able to move funds out of Wise and into another Canadian account using Interac e-Transfer Payouts.