Intel’s new CEO Pat Gelsinger raised eyebrows announcing a bold plan, Intel Foundry Services in a live webcast. He said it will make “the new Intel” more aggressive and flexible with a string of new chip manufacturing plants in the US and Europe. Intel plans to still make its own chips but will offer to make chips for partners and competitors.

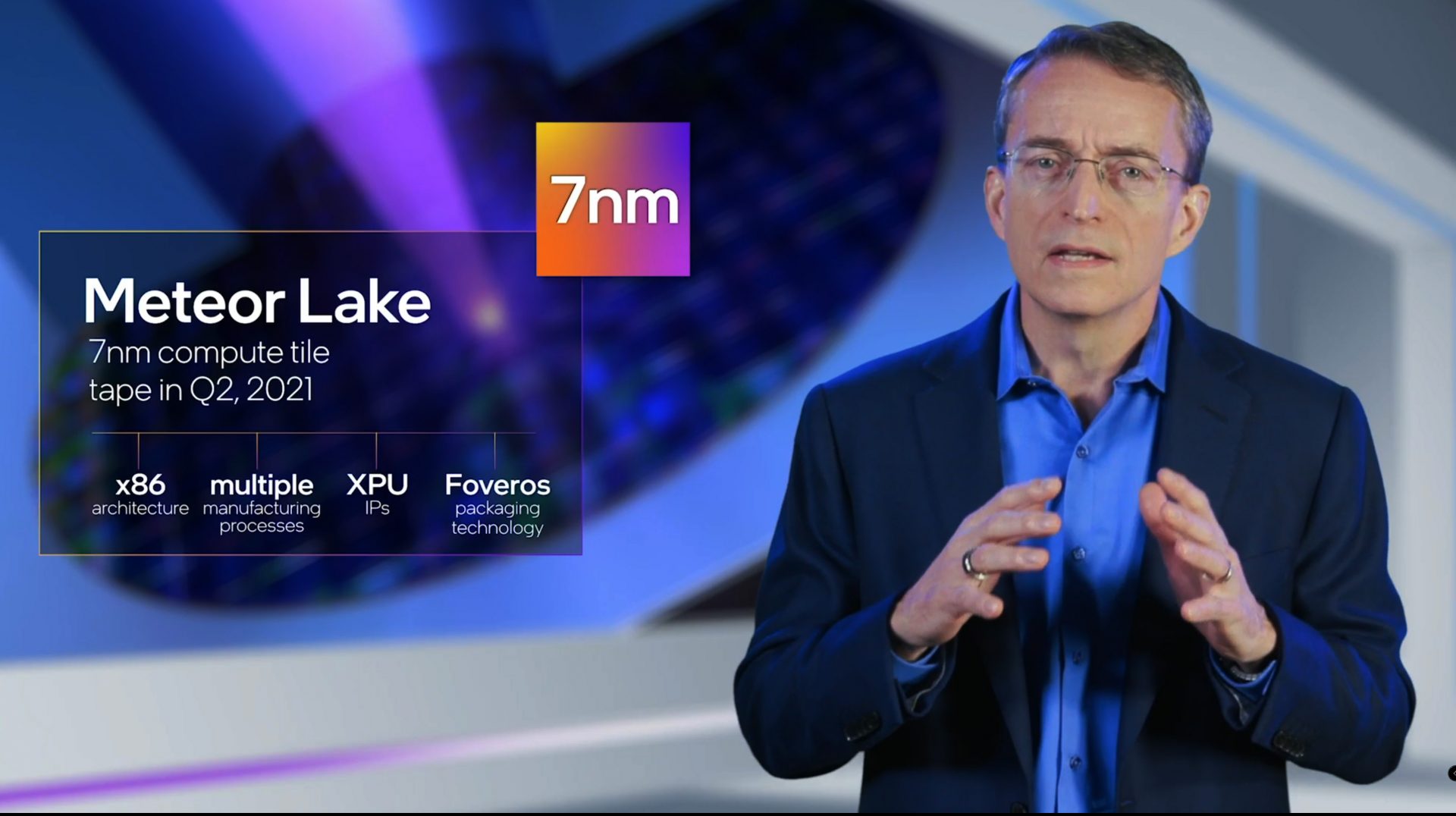

Gelsinger, a 30-year Intel veteran left after rising to CTO for software maker VMware. He recently returned to a company plagued with complacency, lack of direction and facing stiff competition. Companies like AMD and Apple have already embraced 7nm and 5nm (nanometers, or billionths of a meter) transistor manufacturing respectively compared to Intel’s current 14nm platform.

In a live webcast meeting he politely described Intel’s missed opportunities for introducing 7nm chip technology even delaying 10nm chip manufacturing and sticking with 14nm technology in its newest flagship 11th Gen Rocket Lake processor in stores next month. Although Intel still boasts the fastest gaming chips, competitor AMD is gaining consumer popularity with better multi-tasking Windows desktops and laptops (smaller nm manufacturing allows for more multi-tasking cores) with up to twice as more cores for better multi-tasking.

Not Intel’s First 180-Degree About Turn

This is not the first time Intel made bold direction adjustments in its consumer and business chips. In 2005 the chip giant introduced Intel Core microarchitecture in favour of the then well recognized Pentium brand delegating it to budget PCs. Intel Core technology was the work of Intel’s Israel research labs. The technology continues today after yearly performance and feature improvements which are porting over to Intel’s first serious competitive Alder Lake 10nm platform. Out in the second half of 2021 Intel boasts more than 150 designs from computer makers embracing Alder Lake.

The new independent Intel Foundry Services will not only accelerate the company’s chip technology but can also make other companies’ chips “including Apple”, said Gelsinger.

Gelsinger noted Intel’s 2023 shift to its 7nm process, doubling the number of circuitry elements that fit into a given area. “Intel is back. The old Intel is now the new Intel as we look to the future,” Gelsinger said. “Our confidence in 7nm’s health and competitiveness is accelerating.”

Intel Will Build Chips for Competitors

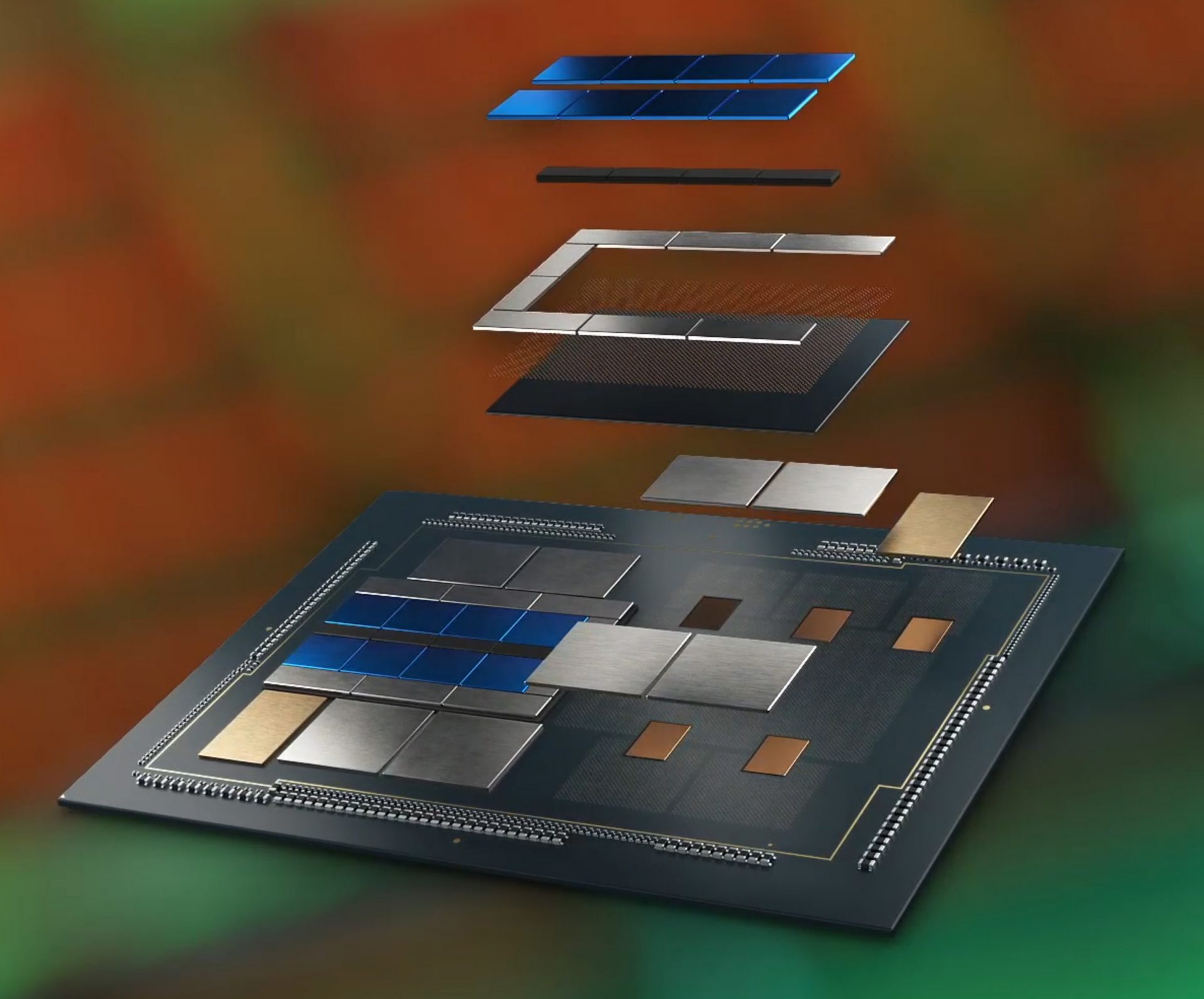

With Intel’s $20 billion USD announcement for two foundries (called fabs) in Arizona and several in Europe the chip giant must in essence adopt standard tools of competitive chip makers, a formidable task for a company that historically relied on its own chip design.

Intel said customers will build chips using its own x86 processor cores and the Arm smartphone designs. Intel customers will also be able to build chips using RISC-V, a newer rival to Arm designs.

Although Gelsinger said Intel’s foundry efforts “were weak” he asserted things will be different this time. Intel Foundry services will be a separate business unit reporting to him, he said. It will have its own profit responsibilities, with a dedicated capacity for customers.

The Intel strategy might be fruitious timing during a major global chip shortage and a building distrust of overseas chip makers. Taiwan Semiconductor Manufacturing Company TSMC plans to spend $28 billion on new chipmaking capacity this year to to meet demand according to CNET. Still, Gelsinger admitted it takes time for such foundries to mature and deliver to customers.

Gelsinger noted that despite its new foundry services Intel will increase its near term reliance on other foundries, including TSMC, Samsung in Korea and UMC in Taiwan, But he made it clear Intel’s primary strategy is to build its own chips.

During the webcast Microsoft CEO Satya Nadella personally offered his support for Intel’s bold plans, a strong vote of confidence compared to other tech giants like Amazon, Google, Ericsson, Cisco and Qualcomm also endorsing Intel’s move in one quick slide during the webcast. Intel also announced a chip technology and packaging partnership with IBM.